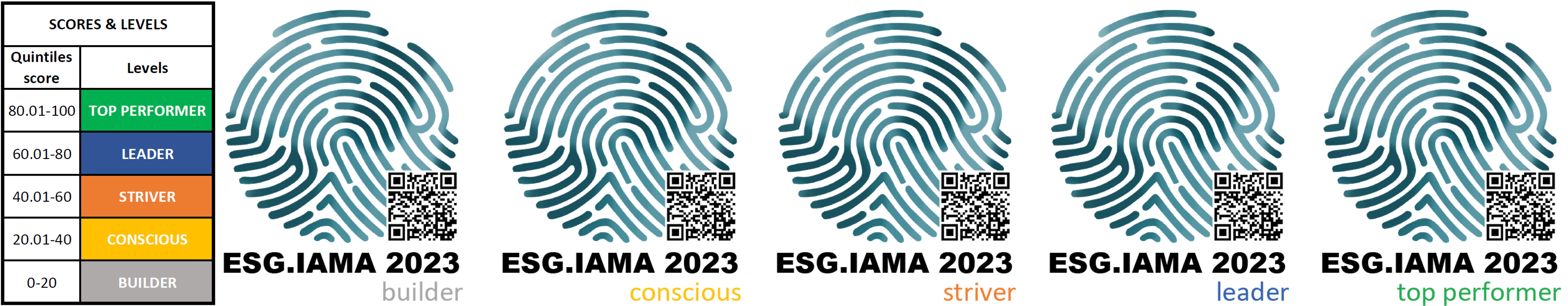

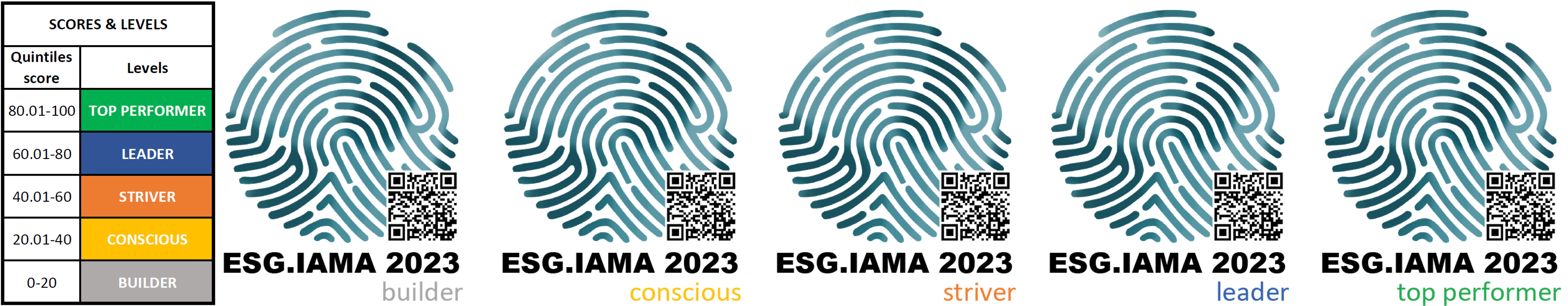

The ESG.IAMA label is a recognition to the Asset Managers that accept the challenge of the ESG Identity Asset Manager Assessment.

Which is the label’s value?

It certifies the Asset Manager’s ability to expose itself on the three ESG areas and signals the activation of a serious path to transform and evolve its Identity through the ESG key. It is not an outcome stamp, but an indicator of consistency, commitment and vision.

Why a label?

The ESG.IAMA label was born within the path of the ESG Identity Asset Manager Assessment, a scientific project developed by ET.Group in 2022. The research is the first quantitative index that set out to measure the Asset Managers’ ESG Identity, which includes the set of distinctive elements of an entity, starting from its organizational structure (governance) to the ESG consistency and coherence of its products to the market, going through the ways in which the entity thinks (its ESG corporate culture) and engages on the sustainable front (its ESG purpose).

The results of the ESG.IAMA project have created great knowledge value.

- For the system, from the Asset Managers community to investors, because trend analysis allows for the development of dialogue, discussion, and the identification of trends and best practices.

- For the Asset Managers, because it allows them to have a tool to: 1. Implement awareness; 2. Develop internal alignment and comparison between functions; 3. Benchmark against other Asset Managers; 4. Develop benchmarking with themselves.

Today, the ESG.IAMA project has taken on the connotations of an indicator of the Asset Manager’s ESG Identity.

Therefore, it can also represent great value in terms of recognition for the Asset Managers.

That is why the ESG.IAMA label was created: it is an award for courage, commitment and the belief to be on the frontier of sustainability.

More about both the ESG.IAMA project here.

To have information or participate to ESG.IAMA write to clientservice@esgiama.com

Sponsor of ESG.IAMA 2023

Top 3 Asset Managers of ESG.IAMA 2023 per each category:

ESG.IAMA:

1. Allianz Global Investors

2. Candriam

3. Legal & General Investment Management

Corporate ESG Identity:

1. Legal & General Investment Management

2. Nordea Asset Management

3. Candriam

ESG Investment Process:

1. Allianz Global Investors

2. UBS Asset Management

3. Candriam

ESG Asset Management:

1. Legal & General Investment Management

2. Nordea Asset Management

3. Allianz Global Investors

ESG Identity Extended:

1. Schroders

2. Nordea Asset Management

3. Allianz Global Investors

Large size AM:

1. Legal & General Investment Management

2. UBS Asset Management

3. Amundi Asset Management

Mid-size AM:

1. Allianz Global Investors

2. Schroders

3. BNP Paribas Asset Management

Small size AM:

1. Candriam

2. Nordea Asset Management

3. DPAM

Boutique size AM:

1. Rothschild & Co Asset Management

2. Etica SGR

3. La Financière de l’Echiquier

SGR italiane:

1. Etica SGR

2. Generali Insurance Asset Management SGR

3. Eurizon Capital SGR

ESG.IAMA 2023 – the highest overall score in the research

Corporate ESG Identity 2023 – highest score in the section on how sustainability is internalized at the corporate level by the Asset Manager in its governance processes

ESG Investment Process 2023 – the highest score in the section on how the ESG-specific investment process is structured

ESG Asset Management 2023 – the highest score in the section on how the invested asset management process is structured and how dialogue takes place to achieve specific ESG objectives

ESG Identity Extended 2023 – the highest score in the area related to how the Asset Manager manages relationships with stakeholders and the value chain, measuring the effects and impacts of its initiatives

Large size AM 2023 – the highest overall score in the research, from an Asset Manager with Aum over one trillion euros

Mid-size AM 2023 – the highest overall score in the research, from an Asset Manager with Aum between €300 billion and €1 trillion

Small size AM 2023 – the highest overall score in the search, from an Asset Manager with Aum between €25 billion and €300 billion

Boutique size AM 2023 – the highest overall score in the search, by an Asset Manager with Aum of less than €25 billion

Italian Asset Manager 2023 – the highest overall score in the search, from an Asset Manager headquartered in Italy

ESG.IAMA 2023 Asset Managers (50)

BANK J. SAFRA SARASIN ASSET MANAGEMENT

BNP PARIBAS ASSET MANAGEMENT

COLUMBIA THREADNEEDLE INVESTMENTS

EDMOND DE ROTHSCHILD ASSET MANAGEMENT (FRANCE)

FIDEURAM ASSET MANAGEMENT IRELAND

FIDEURAM ASSET MANAGEMENT SGR

GENERALI INSURANCE ASSET MANAGEMENT SGR

GROUPAMA ASSET MANAGEMENT

IFP INVESTMENT MANAGEMENT

J.P. MORGAN ASSET MANAGEMENT

LA FINANCIÈRE DE L'ECHIQUIER

LEGAL & GENERAL INVESTMENT MANAGEMENT

OFI INVEST ASSET MANAGEMENT

ROTHSCHILD & CO ASSET MANAGEMENT

STATE STREET GLOBAL ADVISORS

VONTOBEL ASSET MANAGEMENT

Those who are not on the list have not given permission for their names to be published among the participants.